· $5, /year. $6, /year. A few notes. First, note that this limit is a combined limit for traditional and Roth contributions. Thus, while you can contribute to both in the same year, the total contribution cannot exceed the $5, (or $6, ) limit. Second, your traditional IRA contributions may be tax deductible, depending on Estimated Reading Time: 7 mins · Contribution Limits For Roth & Traditional IRA. saw the contribution limit both Roth and Traditional IRAs stay at $5, for people under the age of If you are older than 50 this year you are able to make catch up contributions to your account of $1, – which means your limit Reviews: 2 Roth IRA Contribution Limits Just like the traditional IRA, the maximum Roth IRA contribution limits are still the same as with the previous year. The standard contribution remains at $ maximum, and this is applicable to those individuals who are below the age of 50

Roth IRA Contribution and Income Limits for

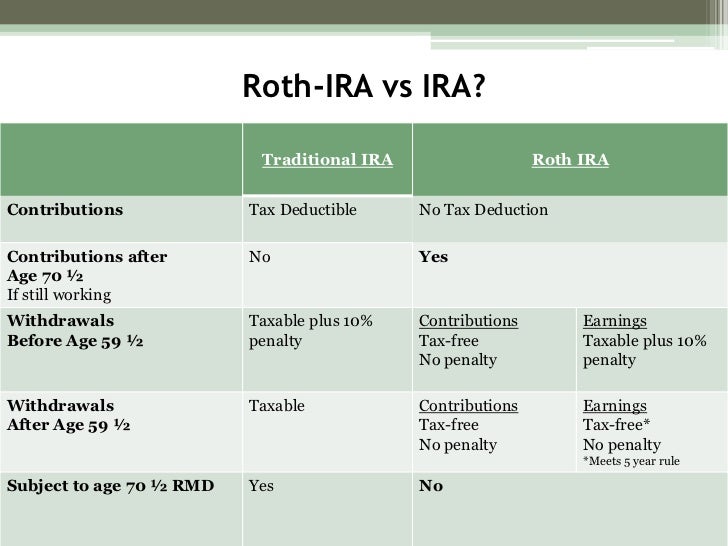

Another great advantage to the Roth IRA is that you can take out the contributions you put in without any penalties. This is due to the fact that you have already paid taxes on that money opposed to a traditional IRA where you put pre-tax money in and get the tax break now. As wonderful as the Roth IRA can be you can only put so much into it each year and there are limits to how much you can make as well. Congress is always tinkering with the tax code and making changes nearly every year and in nearly all categories, and that includes Roth IRA contribution and income limits.

You can make contributions to both a Roth IRA and a traditional IRA, but there are a couple of considerations to keep in mind:, roth ira single income limit 2012. Income limits for eligible Roth IRA contributions for are, as they have been in the past, dependent on your filing status. They mean adjusted gross income, plus or minus a few other things —some uncommon, roth ira single income limit 2012, some not so uncommon. You start with your AGI—you just have to love the many IRS monikers—then add and subtract from there.

Modified adjusted gross income MAGI for FORM line 7 is determined by computing AGI without:. One final note : since these calculations can get fairly complicated, and since provisions DO change, if you think you may be coming up on the Roth IRA limits it is strongly recommended that you discuss your Roth IRA contribution plans with your tax advisor.

The penalties for over-funding or making a contribution erroneously are substantial. Glen Craig is married and the father to four children that he spends the day chasing as a stay-at-home-dad.

He took an interest in personal finance when he realized most of his paycheck was going toward credit card bills. Since then he's eliminated his credit card debt roth ira single income limit 2012 started on a journey towards financial freedom. I am on ss. I have money in other funds that I want to put into ROTH IRA. I am a self employed beautician and make a small amt of income.

Usually net about thousand each year, roth ira single income limit 2012. Your email address will not be published. Notify me of followup comments via e-mail. Save my name, email, and website in this browser for the next time I comment. This site uses Akismet to reduce spam. Learn how your comment data is processed. Free From Broke is for general information or entertainment purposes only and does not constitute professional financial advice.

Be smart and do your own research or contact an independent financial professional for advice regarding your specific situation. In accordance with FTC guidelines, we state that we have a financial roth ira single income limit 2012 with companies mentioned in this website. This may include receiving access to free products and services for product and service reviews and giveaways.

No content on this site may be reused in any fashion without written permission from FreeFromBroke. roth ira single income limit 2012 Privacy Policy Sitemap.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer Home Personal Finance Debt Saving Investing Best Online Brokerages Taxes Credit Scores.

You Are Here: Home » Retirement » Roth IRA Contribution and Income Limits for Comments I am on ss. Leave a Reply Cancel reply Your email address will not be published. you MUST enable javascript to be able to comment. Footer More About Archives Contact Us Get Our Newsletter. More Recent Articles Think Long Term When Shopping Black Friday and Cyber Monday 10 Essential Tips For Shopping Black Friday And Cyber Monday That Will Save You Money How to Improve Your Credit Score Fast What is a Refund Anticipation Loan RAL and is it Worth It?

Paying Taxes with a Credit Card: Pros and Cons. Disclaimer Free From Broke is for general information or entertainment purposes only and does not constitute professional financial advice.

Go to mobile version, roth ira single income limit 2012. Close GDPR Cookie Settings. Powered by GDPR Cookie Compliance. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

Enable or Disable Cookies. Enable All Save Settings.

Roth IRA Contribution Limits

· $5, /year. $6, /year. A few notes. First, note that this limit is a combined limit for traditional and Roth contributions. Thus, while you can contribute to both in the same year, the total contribution cannot exceed the $5, (or $6, ) limit. Second, your traditional IRA contributions may be tax deductible, depending on Estimated Reading Time: 7 mins · Contribution Limits For Roth & Traditional IRA. saw the contribution limit both Roth and Traditional IRAs stay at $5, for people under the age of If you are older than 50 this year you are able to make catch up contributions to your account of $1, – which means your limit Reviews: 2 Unless you earn too much to qualify, the maximum Roth IRA contribution limits are: $5, if you're under age 50 $6, if you're over age 50

Keine Kommentare:

Kommentar veröffentlichen